As cities and towns in Massachusetts consider whether to allow marijuana-related uses in their communities, many are doing the math and deciding it’s not worth it.

Westborough was the first to “Opt Out” AND others are following suit having asked themselves whether increased drug use and it’s predictable impacts on youth use rates, adult heavy use of an increasingly potent drug, and youth and adult addiction, are compatible with the brand of their communities.

The media loves headlines pronouncing the amount of revenue that taxing marijuana commerce may bring into states. But as is often the case with marijuana coverage, rarely do reporters inquire deeply and rarely do they put marijuana revenue into the context of public health, enforcement and societal costs, and seldom do they do the math.

In the business world, any potential revenue stream is weighed against ability to meaningfully contribute to the financial health of the company and against its costs. The same should be true for revenue derived from State and Federal policy.

The possibility of $100 million a year in state tax revenue from commercializing marijuana is getting a lot of press in Massachusetts for example.

$100 million in revenue per year would contribute a mere .002% of the State’s annual ($40.1 Billion) budget. It takes around $110 million PER DAY to run the State. So all the revenue would net Massachusetts less than one day’s operating needs.

That amount of revenue (.002% of total budget) alone, in business, is insufficient motivation to pursue a new market segment. Then look at the costs. When you associate the costs of regulation, enforcement, addiction, prevention, public health, healthcare, and societal costs, and the proposition is a total loser. And that’s before the inevitable price collapse that sees revenues decline as pot prices tumble under over supply. Oversupply in Oregon has caused a dramatic price collapse. [“How do you move mountains of unwanted weed?”] Taxes are tied to revenue which is tied to price. As prices collapse, so goes your tax revenue. Meanwhile, your costs escalate regardless. Your town is likely to get very little in revenue to offset regulation, inspection and enforcement of these establishments, let alone undo ill effects of increased youth and adult use.

The same is true for cities and towns. In Westborough the voters overwhelmingly (by a vote of more than 80% of the voters) chose to pass on this revenue because, 1) these uses are incompatible with their brand as family and education focused; and 2) because the revenue is not worth taking. Westborough voters did the math. If commercial marijuana uses generated $1 million in revenue, at the 2% local tax rate allowed in the law at the time, the Town would realize a meager $20,0000 dollars in tax–.0002% of its operating budget. Even at 3%, the revenue is paltry.

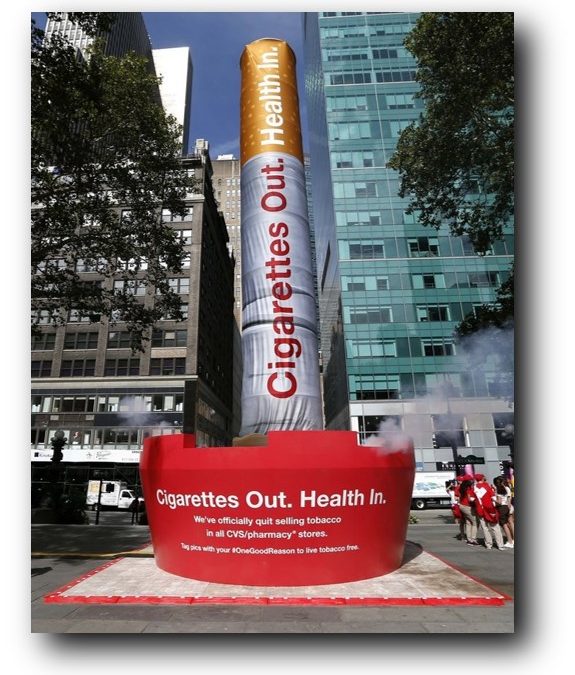

Beyond the numbers, if you look at this industry ethically, we should reflect on the actions of CVS Pharmacy. CVS chose to give up $2 Billion in annual revenue from sale of tobacco products. Two BILLION is two thousand million. Every year. That’s 20 times what The Commonwealth might see in annual revenue.

Why? Because a) it was deemed incompatible with the CVS brand as a wellness company; and b) because it was, in their words, the “right thing to do.”

Some revenue is not worth taking. As Denver Mayor Hancock famously said, “We will never prosper disguising marijuana proceeds as taxes and fees.”

Experience of Others Doing the Math on Marijuana Tax Revenue:

Here’s the experience of one Colorado school district who shared their experience of “The Marijuana Money Myth”. The tax rates and structure may differ than those in your State, but the reality of it doing any good at the local level won’t. Read about it in this article and or watch this video:

One Massachusetts Opt-Out Town’s Math on Marijuana Taxes–Again, some revenue is not worth taking:

Here’s the math from Scituate, MA, one of the 190+ Massachusetts communities that have opted-out or passed a moratorium on commercial marijuana establishments:

How much money are we talking about? There are no examples of recreational businesses in Massachusetts yet. The way towns are banning recreational now, it’s even harder to say how effectively the recreational industry will take root. According to industry marketing site Weedmaps, the average marijuana retailer in Washington and Colorado generates between $2,643,280 and $2,494,776 in annual sales, respectively. If Massachusetts’ recreational marijuana industry evolves in a similar fashion (again, no one knows for sure), a typical marijuana retailer would generate an estimated $2.5 million in annual sales. With a 3% local excise tax, municipal governments could collect approximately $75,000 in tax revenue from a retail business each year. That amounts to .1% (one tenth of one percent) of Scituate 2019 town budget. This commercial cannabis/THC-product revenue would not come close to covering the costs that commercial marijuana commerce will impose on the Town. It would not cover even one new benefited position to address addiction costs to public safety, or school services, or family health services, or board of health services or other unanticipated costs associated with an increased supply of this drug in the community. This is why we choose to opt-out and ban commercial marijuana establishments through the exercise of local control.

Amherst, MA, estimated $550,000 in additional local costs annually if the marijuana industry became entrenched there: http://wamc.org/post/amherst-official-says-college-town-will-need-more-staff-when-pot-stores-open